There is very little that has remained unaffected by the COVID-19 crisis. An unprecedented impact has been felt on the global economy, manufacturing, supply chains and, overwhelmingly, individual lives. It is not surprising the pandemic has also affected the electric power market in the United States and around the world.

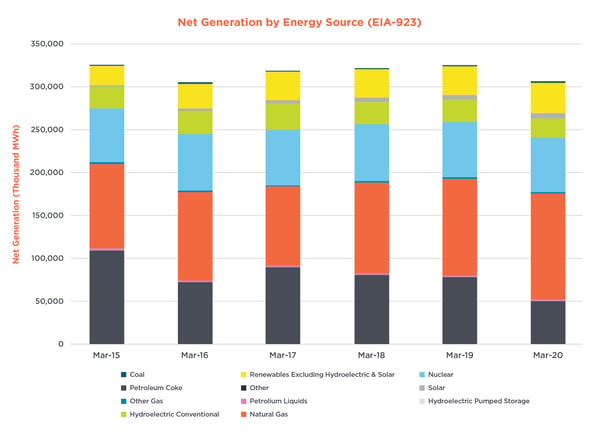

Analyzing information utilities have reported, net generation fell year over year (YoY), when comparing March 2019 to March 2020, falling by 5.56%. The following chart derived from U.S. Energy Information Administration (EIA) shows net generation usage compared to contiguous United States average temperature (provided by the National Oceanic and Atmospheric Administration) and an estimate for U.S. gross domestic product (provided by Federal Reserve Economic Data).

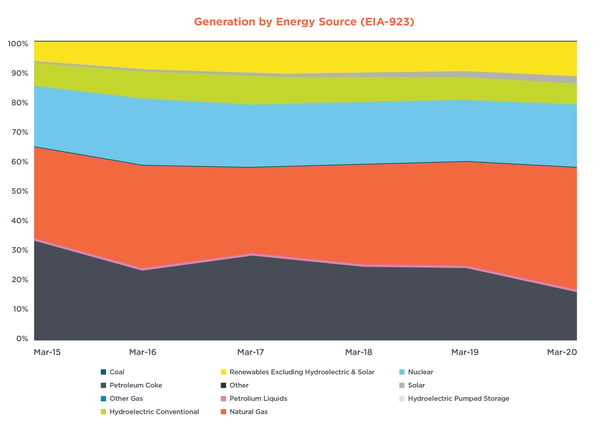

An aspect especially noteworthy about this decline in generation isn’t necessarily the cause of the reduction, whether due to COVID-19, ambient temperature (heating/cooling loads), demand side management, electrification or myriad other factors. Rather, it is interesting to see how independent system operators and balancing authorities are dispatching generating assets to meet the reduced demand. Specifically, net generation from renewable, nuclear and hydroelectric power remained relatively constant YoY from March 2019 to March 2020, while natural gas production increased and coal power decreased proportionally. The following EIA charts show that coal power only accounted for 16.5% of total net generation in March 2020, which is 7.2% lower than the next lowest sample point in March 2016.

The reduction in coal generation and increase in natural gas generation appears to be driven by the contraction in the price spread between delivered natural gas and coal prices in response to decreased demand and economic uncertainty resulting from COVID-19. Natural gas prices decreased from an average of $3.48/MMBtu in March 2019 to $2.16/MMBtu in March 2020, while coal prices decreased from $2.07/MMBtu to $1.92/MMBtu over the same time-period (provided by Form EIA-923).

Due to a typically better heat rate of natural gas combined-cycle units compared to coal-fired units, as well as the higher variable operations and maintenance costs associated coal production (due to emissions controls and greater staffing needs), many coal-fired facilities’ costs were pushed higher in the generation supply curve. This moved coal asset production away from baseload and into intermediate production as these resources became the marginal generating units. As a result, coal power plant operation and production costs set the localized marginal price in specific markets and their generation fluctuated to meet electric demand.

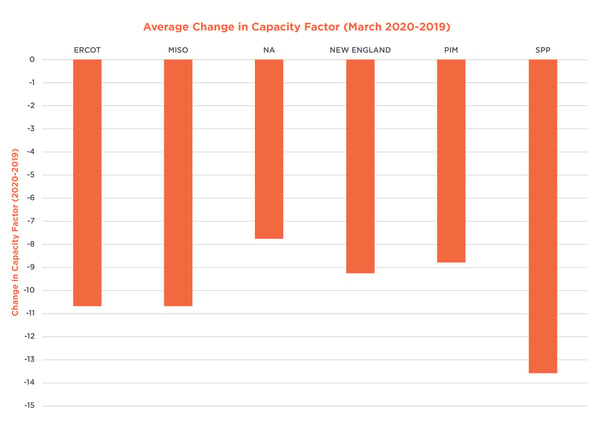

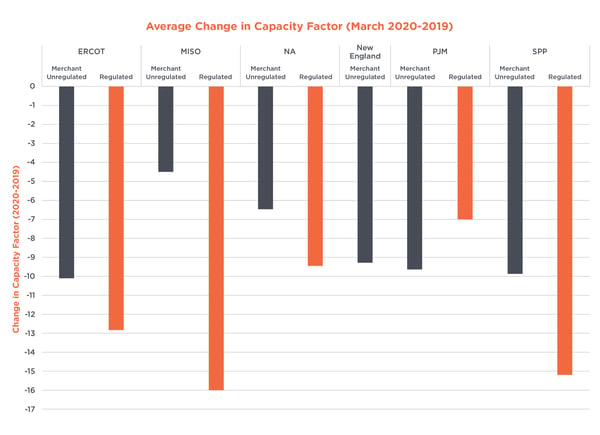

Diving deeper into this generation data on a unit by unit basis yielded some interesting results. First, impacts on coal generation vary across the United States. This chart shows the change in capacity factor for coal units by independent system operators between March 2019 and March 2020.

This shows that coal assets in Southwest Power Pool (SPP) have seen the largest decline in capacity factor while coal assets not associated with an ISO, marked as NA in the chart, have seen the smallest reduction. Furthermore, it appears that regulated assets on average have been curtailed more than merchant unregulated assets.

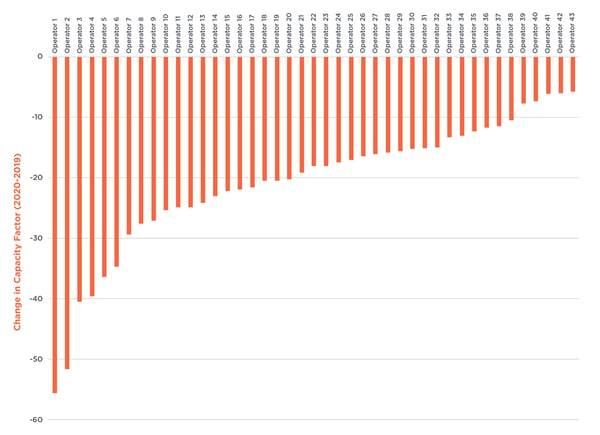

Analyzing the units by asset operator shows that some operators may be more impacted by the current market dynamics than others. It should be noted that the reason for the capacity factor reduction is not known and could be a result of a planned or unplanned outage and thus not associated with changes in dispatch. On an aggregate level, however, this should be relatively constant, but large unit outages for specific operators may have skewed this figure.

COVID-19, as well as a sustained environment of low natural gas prices and decreased electric demand, have significantly impacted wholesale power markets and coal generation. If these conditions persist, coal-fired generation will further shift to an intermediate energy resource. This will result in economic pressures on these assets and may result in early retirements or seasonal reserve shutdowns due to decreased utilization, higher maintenance costs and continued declines in net generation.

With impacts from COVID-19 likely to have long-term impacts, the energy industry will need to continue to assess viable energy solutions moving forward. As a first consideration, coal operators/owners should evaluate coal/consumable contracting strategies, equipment reliability activities, capital expenditure planning, short/long term layup procedures and the role these assets play in the local electric power markets.

Assessing assets and responding to industry trends can be a difficult process to navigate. Learn how our experienced team can help simplify the process with knowledgeable asset feasibility evaluations.